AI-Driven Innovations in Enterprise Data Storage for Financial Data Management

LIKE.TG 成立于2020年,总部位于马来西亚,是首家汇集全球互联网产品,提供一站式软件产品解决方案的综合性品牌。唯一官方网站:www.like.tg

The financial industry is facing a data revolution. With more information available than ever before, it’s crucial that companies are equipped with the right tools to manage, store, and analyze this data. However, that’s rarely the case. McKinsey reports only 7% of banks are completely utilizing crucial analytics, which shows that a vast majority of financial institutions are not maximizing the potential of their data. This is where artificial intelligence (AI) comes in.

AI-driven innovations in enterprise data storage are transforming the way financial data is managed and stored, enabling businesses to unlock valuable insights and stay ahead of the competition. This blog delves into the advancements in AI-driven technologies that are revolutionizing the way financial data is stored and managed in enterprises, and their impact on the future of the industry.

Rethinking Data Storage: The Evolution of Financial Services Technology

For many years, the financial industry relied on relational database management systems (RDBMS) as the primary data storage solution. These systems store data in a structured format and are based on a predefined schema.

However, as financial institutions continue to digitize their services, the amount of data they generate and store is growing exponentially, and the limitations of RDBMS are becoming evident.

The rigid structure of these systems makes it difficult to store unstructured data, such as audio and video, which is becoming increasingly important in the financial industry.

The Rise of Big Data and AI-Powered Data Storage

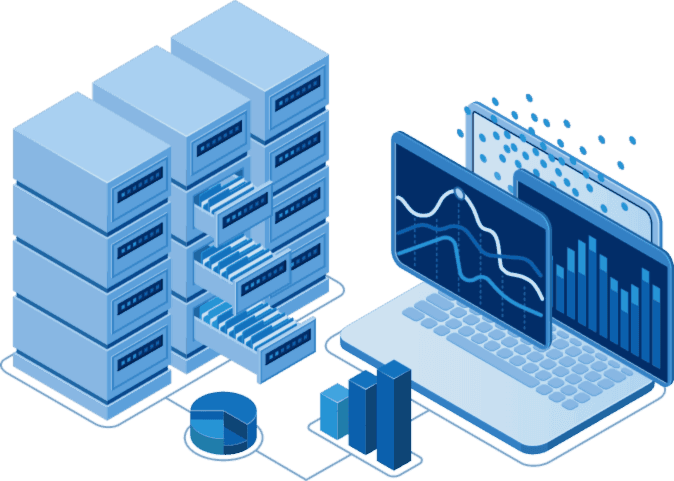

The rise of big data has brought challenges to the forefront of financial institutions. They are now seeking sophisticated and scalable data storage solutions capable of handling massive amounts of structured and unstructured data in real-time.

This is where AI-driven innovations in enterprise data storage come in, allowing financial institutions to store and manage data more efficiently and effectively than ever before.

AI technologies, like machine learning, can help optimize data storage and retrieval processes, automate maintenance and backup tasks, and improve overall system performance.

For instance, AI can analyze user behavior and predict future storage needs, enabling financial institutions to scale their storage solutions accordingly. Additionally, AI can automatically detect and address system errors and anomalies, reducing downtime and improving system reliability.

Cloud-based solutions are also an important aspect of this revolution, as they offer scalability, improved accessibility and collaboration, advanced security features, and cost savings over traditional on-premise storage solutions.

Embracing these technologies gives financial institutions a competitive edge in a data-intensive world.

Practical Applications and Use Cases

In addition to solving the challenges of data storage in the financial industry, AI-driven innovations in data storage are also being used to create new products and services, improve customer experience, and drive revenue growth.

Here are some of the most innovative use cases of AI-driven data storage in the financial industry:

- Fraud Detection and Prevention: Financial institutions are using AI to detect and prevent fraud. AI algorithms can analyze large amounts of data in real-time to identify unusual patterns of behavior, flag suspicious transactions, and predict potential fraud before it occurs. In fact, 64% of financial institutions believe AI can get ahead of fraud before it happens.

- Trading and Investment Management: AI-powered data storage solutions are being used to analyze market data and provide insights into trading and investment opportunities. These solutions can process large amounts of data quickly, identify patterns, and make predictions that can help traders and investors make informed decisions.

- Risk Management and Compliance: AI-powered data storage solutions also help identify and mitigate risks in the financial industry. These solutions can analyze vast amounts of data to identify potential risks and make predictions about future risks, allowing financial institutions to take proactive measures to minimize risk and ensure compliance with regulatory requirements.

Innovations in AI-Driven Enterprise Data Storage

Let’s examine some of the most promising AI-driven innovations in enterprise data storage and their potential to transform the financial industry.

AI-based data classification and storage optimization

This solution leverages AI to automatically classify data based on various factors such as age, usage frequency, and importance. The AI then assigns the most appropriate storage tier to the data, optimizing storage utilization and reducing costs.

Hybrid cloud solutions with AI-driven auto-tiering and data migration

Hybrid cloud combines public and private cloud benefits for financial institutions. Sensitive finance data can be stored on-premise while leveraging cloud scalability and cost-effectiveness. AI-driven auto-tiering and data migration facilitate the seamless movement of data between on-premise and cloud-based storage, ensuring optimal storage utilization and cost efficiency.

Multi-cloud solutions with AI-powered data replication and synchronization

Multi-cloud systems enable financial institutions to store data across multiple cloud providers, minimizing the risk of data loss and downtime due to cloud outages. AI-powered data replication and synchronization ensure that data is seamlessly and continuously replicated across multiple cloud providers, providing redundancy and data availability.

AI-powered data backup and disaster recovery

Financial institutions can leverage AI to automatically back up critical data in real-time and quickly recover from disasters such as cyber-attacks, natural disasters, and human error. AI can monitor data changes and patterns to detect anomalies and proactively trigger backup and recovery processes, minimizing data loss and downtime.

AI-based data encryption and security

With the increasing threat of data breaches, financial institutions are turning to AI-based solutions to protect their sensitive data. AI can analyze patterns in user behavior, network traffic, and system logs to detect and respond to potential security threats in real-time. AI can also automate data encryption, ensuring that sensitive data is protected both at rest and in transit.

How AI is Shaping the Future of Financial Data Management

The use of AI in financial data management has come a long way, and there are many more exciting advancements on the horizon. Here are some of the most significant ways AI is expected to shape the future of financial data management:

Blockchain Technology

Blockchain technology, with its decentralized, immutable ledger system, has the potential to revolutionize the way financial data is stored, secured, and shared. With AI-powered smart contracts, blockchain can be used to automate and streamline financial transactions, reduce errors, and improve overall efficiency.

Natural Language Processing (NLP)

NLP is another technology that is rapidly evolving and expected to play a significant role in the future of financial data management. NLP can be used to analyze vast amounts of unstructured financial data such as news articles, social media posts, and earnings reports. This can provide financial institutions with valuable insights into market trends, sentiment, and other factors that can impact investment decisions.

Automated Data Management Solutions

AI-powered automated data management solutions with native support for multiple cloud storage providers have revolutionized enterprise data storage by enabling the creation of end-to-end data pipelines. This allows financial institutions to optimize their data storage, analysis, and retrieval processes across multiple cloud platforms seamlessly.

AI-Driven Future for Financial Institutions

Incorporating these AI-driven innovations in enterprise data storage can help financial institutions optimize storage utilization, ensure data availability, eliminate redundancy, and protect sensitive data from security threats. From automated data management solutions to blockchain and NLP, AI-driven innovations are poised to revolutionize the way we handle financial data.

As we look to the future, we can expect even more groundbreaking developments to emerge, empowering financial institutions to harness the full potential of AI and drive greater business growth.

现在关注【LIKE.TG出海指南频道】、【LIKE.TG生态链-全球资源互联社区】,即可免费领取【WhatsApp、LINE、Telegram、Twitter、ZALO云控】等获客工具试用、【住宅IP、号段筛选】等免费资源,机会难得,快来解锁更多资源,助力您的业务飞速成长!点击【联系客服】

本文由LIKE.TG编辑部转载自互联网并编辑,如有侵权影响,请联系官方客服,将为您妥善处理。

This article is republished from public internet and edited by the LIKE.TG editorial department. If there is any infringement, please contact our official customer service for proper handling.