数据推广

Invoicing Made Simple: How Automated Data Extraction Can Save You 75% Cost in Finance

The world of finance is jam-packed with data. As the landscape of commercial transactions continues to evolve, finance professionals must deal with an influx of invoices, receipts, and payments. To provide a unified view of invoice data, ensure timely payments and improve vendor relationships, enterprises are looking to adopt modern data extraction techniques.

Fortunately, there’s a solution: automated invoice data extraction. By utilizing AI-based techniques, businesses can save up to 30–40% of the time typically spent on manual processing. Automating the capture and processing of invoice data allows finance teams to optimize their workflows, cut costs, and break down data barriers. This results in improved data visibility and better-informed decision-making, giving businesses a distinct competitive advantage.

From Manual to Automated: How a Financial Services Company Reduced Costs and Boosted Efficiency

A US-based global financial services organization handled over 500 invoices from multiple vendors and suppliers daily. The sheer volume of invoices meant their accounts payable team struggled to process them efficiently. Also, each invoice had a different layout, which made it challenging for their team to extract the relevant data accurately.

Moreover, a data quality audit revealed that a significant portion of their financial data was incorrect due to human error in the data entry process. On average, the cost of fixing these errors was $53.50 per paper invoice, leading to losses that ultimately affected their bottom line.

Recognizing the urgent need to enhance invoice processing efficiency and data accuracy, the company opted for an automated invoice data extraction solution. By implementing this solution, the company successfully automated the extraction of crucial metrics from their invoices, including invoice number, total amount, and due date. As a result of the solution’s capability to manage multiple vendor invoicing formats and layouts, their team was able to effortlessly extract precise data with efficiency.

The results were staggering. The implementation of automated invoice data extraction enabled the company to process a significantly higher number of invoices without manual intervention, saving them time and resources.

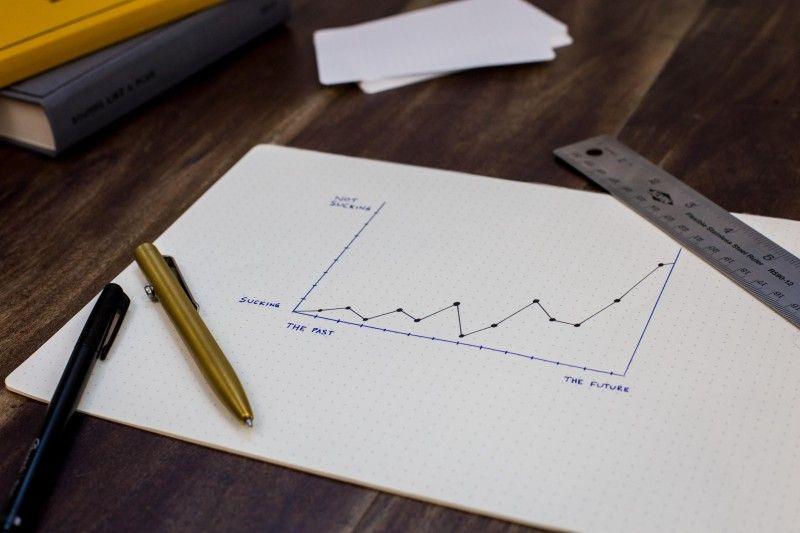

A Sneak-Peak into How the Company Reduced Error-Related Costs

With costs associated with manual labor for invoice processing eliminated, let’s explore how the global financial services enterprise effectively reduced its expenses. Here’s a breakdown specifically highlighting the cost implications of errors:

The company processed 15,000 paper invoices per month, resulting in a 2% error rate or 300 invoices requiring correction. This error mainly occurred due to manual entry of data. The average cost to rectify each error was $53.50, resulting in a total monthly cost of $16,050 for those 300 invoices.

However, after implementing the automated invoice data extraction solution, the company managed to reduce the error rate to less than 0.5%, leaving less than 75 invoices with errors that needed attention. Consequently, the new total cost of addressing errors for these 75 invoices amounted to $4,012.50 per month, showcasing a substantial 75% reduction in error-related expenses, representing yearly savings of roughly $48,000.

This company’s success story serves as a compelling testament to the effectiveness of automated invoice data extraction solutions and highlights why it’s essential for any organization looking to stay ahead in the game.

Automation AI: How the Global Financial Services Company Achieved Success in Invoice Processing

The US-based company has revolutionized its financial operations by harnessing the power of automation and AI, resulting in significant cost savings, improved accuracy, and increased efficiency. Let’s examine their steps to achieve this transformation and see how automation and AI can give companies a competitive edge.

Receipt Capture and Conversion: To start off the automated invoice data extraction process involves capturing receipts and converting them into an electronic format. The company received invoices primarily in PDF format through email. They were processed using optimized email capture and conversion methods to ensure high-quality electronic copies. This enabled accurate and efficient data extraction from the invoices.

Data Extraction and Validation: This stage includes extracting and validating relevant information, including vendor name, invoice number, and total amount. The company employed state-of-the-art deep learning technology to automatically extract financial data, including handwritten text, from various sources. The extracted data was then converted into JSON format for seamless integration with other financial systems. To further enhance accuracy and speed, their invoice data extraction solution was integrated with OpenAI’s language processing models.

Matching with Financial Records: Moving on, the invoice data is then matched with supporting documents, such as purchase orders and contracts. This additional step ensures that the transactions are valid and authorized for payment. At the financial services company, this matching process was automated using AI-powered algorithms that can quickly and accurately match financial data with corresponding records, reducing the need for manual intervention.

Approval Routing: Here financial transactions are automatically routed for approval. This process involves sending the transaction to the payment department based on predefined rules and workflows. At the financial services company, this routing process was automated using AI-powered algorithms that can route transactions quickly and accurately, ensuring that the right people were involved in the approval process.

Posting to Financial Systems: Once the invoices are approved, they are automatically posted to the financial systems. This ensures that the financial data is accurately recorded and available for reporting and analysis. At the financial services company, this posting process was automated using AI-powered algorithms that can post transactions quickly and accurately, reducing the need for manual data entry.

Archiving for Audit and Compliance: Finally, the financial transactions are archived for future audit and compliance purposes. This involves storing the transactions in a secure and easily accessible location. At the company, this archiving process was automated using cloud-based storage solutions to securely store large volumes of financial transactions and make them easily accessible for reporting and analysis.

LIKE.TG ReportMiner: The AI-Powered Solution for Automated Invoice Data Extraction

Managing financial operations can be an arduous task, especially when extracting data from hundreds of invoices with different layouts and formats. With LIKE.TG ReportMiner, an AI-powered data extraction tool, financial organizations like the one we saw in this blog can easily extract necessary data from invoices containing different layouts. Our revolutionary LIKE.TG North Star feature leverages AI to create report models within minutes, allowing your team to focus on other high-value tasks.

But that’s not all! LIKE.TG ReportMiner also offers streamlined data validation through its robust data quality rules transformation. This ensures that your data is always accurate and consistent, empowering you to make informed decisions and promoting compliance with regulations, thereby paving the way for operational efficiency.

Don’t just take our word for it. Sign up for a free 14-day trial today and experience the power of LIKE.TG ReportMiner’s AI-driven data extraction for yourself!

Invoicing Made Simple: How Automated Data Extraction Can Save You 75% Cost in Finance

For decades, processing an invoice essentially meant hand-keying information. The paper bills would pass through multiple touchpoints and require a lot of manual intervention. That has all changed in recent years with automated invoice processing, as enterprises look to reduce the transaction cycle and timeline of paying an invoice from several weeks to days or even minutes. It’s no surprise that automated invoice processing — powered by Artificial Intelligence (AI) and machine learning (ML) — has become a preferred approach for modern businesses. Given the fast adoption of AI data extraction, it’s safe to expect automation to continue being a driving force behind invoice processing. Manual vs. Automated Invoice Processing Manual invoice processing is an error-prone and time-consuming approach that isn’t very efficient — to say the least. It involves receiving paper invoices from vendors, performing manual data entry in the accounting system, matching it against the purchase orders for tolerances, making a scan to add it to the filing system, and sending it for approval. Afterward, each invoice is added to the ERP manually. Once all these steps are completed, then the payment is processed. Now that’s a lengthy manual process that consumes a lot of staff’s time and costs money. 51% of enterprises say manual data causes them the most problems in processing invoices. Enterprises need to quickly pull relevant information from invoices, available in an unstructured format, to process, validate, store, and approve payments in real time. And that’s where automated invoice processing comes in. It automates the entire process of receiving an invoice, extracting information from it, and adding the info to your ERP system. It significantly improves payment processing time, minimizes errors, and helps businesses take advantage of early payment discounts and avert overdue fees. Let’s take a closer look at some of the key benefits it brings to the table. Benefits of Automated Invoice Processing Time and money savings Automated invoice processing software minimize the risk of missing invoices. They save businesses from delayed payments, leading to penalties and strained vendor relationships. Making accurate and timely payments also help companies get discounted rates and favorable credit terms, contributing to a positive cash flow. Improved data accuracy Human error is unavoidable when processing invoices manually. It can easily lead to missed discounts, duplicate payments, and overpayments. On the other hand, using an-AI powered intelligent data capture technology minimizes the chances of human errors to virtually none. Increased productivity Examining invoices, identifying errors, validating their contents, and getting payment approvals are resource-intensive activities. Invoice processing automation eliminates the need to perform these tasks manually, allowing employees to focus on more critical jobs and become more productive. Higher employee morale Manual invoice processing isn’t just time-consuming but also a cumbersome and repetitive activity. Letting AI data extraction solutions take over allows employees to focus on more engaging and higher-value work that would improve their morale. Improved supplier relationships Automation simplifies and streamlines vendor invoice management, facilitating timely payments and efficient dispute handling. Maintaining good working relationships with suppliers goes a long way — it helps companies get quicker services and negotiate better terms, among other benefits. And there are a whole bunch of advantages of invoice workflow automation, including improved audit and regulatory compliance, reduced chances of fraud, and more. Here’s How It Works Some of the steps in setting up an automated invoice processing workflow are: Selecting a file source. This is where incoming invoices are stored. Generating an extraction template. You can also set up data quality rules to ensure consistency within data. Exporting the extracted data to a destination for approval. It’s as simple as that. An automated invoice processing software can leverage AI technologies like natural language processing and machine learning to easily capture important fields, including product or service description, quantity, price, tax information, payment terms, and more. Intelligent document processing software requires minimum human supervision. Modern invoice automation solutions allow users to create pre-defined validation rules to manage anomalies, errors, and missing fields. The validated data goes to the enterprise resource planning or accounting solution for payment approval and recordkeeping. From scanned PDF bills to e-invoices sent through Electronic Data Interchange, an automated solution processes all the invoices coming from different sources with accuracy and speed. This approach streamlines the accounts payable process, allowing enterprises to benefit from low-cost efficiency and maximize productivity. Streamline Invoice Processing with LIKE.TG ReportMiner Discover how LIKE.TG ReportMiner revolutionizes the underwriting process by leveraging AI technologies to extract relevant data from complex reports. See it in Action – View Demo Now! LIKE.TG ReportMiner: Advanced Data Extraction Solution to Automate Invoice Processing LIKE.TG ReportMiner is an end-to-end invoice extraction solution that can transform a large volume of unstructured data into meaningful insights. Using our automated, code-free platform, you can automatically build extraction templates to extract data from invoices. Our solution’s new AI-driven data extraction capabilities have made things easier than ever. Here’s how you can automate invoice processing in three steps: In order to utilize the LIKE.TG North Star feature, you will need to create a new project from Project > New > Integration project or open an existing project in LIKE.TG ReportMiner. Next, right-click on the source files folder in the project explorer and select AI-Powered Data Extraction > Auto Create Report Models using LIKE.TG North Star. Now that the report models have been created, they are ready to be used for data extraction. It’s that simple! Leveraging LIKE.TG ReportMiner’s Auto Capture technology, you can extract data from PDF invoices in a matter of seconds. Moreover, the job scheduling feature will facilitate accounts payable automation. Whenever a new invoice comes from the vendor, the solution automatically extracts data and sends it to your preferred destination. ALSO READ: This Government Department Cuts Down Invoice Data Extraction Time from Hours to Less than a Minute Automate Invoice Processing With AI Automated invoice processing helps accounting and finance departments increase efficiency and data processing time. It reduces manual intervention, minimizes errors, and eliminates unnecessary routing, significantly decreasing invoice processing time. Automate Your Invoice Processing with LIKE.TG’s ReportMiner Our solution reduces manual intervention, minimizes errors, and accelerates data processing. Request a free trial to explore how AI Capture can transform your finance department. Sign Up for a Free 14-day Trial Account payables automation through modern invoice processing software allows employees to shift their focus to more value-added activities. Moreover, efficient vendor invoice management helps companies maintain a good relationship with their suppliers, leading to better business outcomes.

Improving Healthcare: Optimizing Diagnostic Insights through Automation

Automated medical record data extraction tools are revolutionizing healthcare businesses by efficiently extracting and utilizing diagnostic data

Diagnostic data serves as the cornerstone for accurate diagnoses, treatment planning, and monitoring of patient progress. It encompasses a wide array of information, including lab results, imaging reports, pathology findings, and clinical observations. This data holds tremendous potential to enhance clinical decision-making, promote personalized medicine, and facilitate research and development efforts.

To harness the trapped diagnostic data effectively, clinics must implement automated data extraction processes. Fortunately, modern diagnostic data extraction tools are available to extract diagnostic information that would be otherwise inaccessible.

Maximizing the Potential of Diagnostic Data

Effective document processing is essential for unlocking the full potential of diagnostic data in healthcare. Unlike manual extraction processes that are time-consuming and prone to errors, automated and streamlining document processing techniques empower healthcare organizations to harness diagnostic data’s value while improving operational efficiency.

Empowering Possibilities: Data Extraction Automation and Enhanced Outcomes

Data extraction automation technology offers a transformative solution for healthcare businesses seeking to streamline their diagnostic data utilization processes. By employing intelligent algorithms and machine learning techniques, these tools can efficiently scan, interpret, and extract relevant information from medical records with unparalleled accuracy and speed.

Numerous AI techniques can be employed to extract data from semi-structured and unstructured documents. These include deep learning, optical character recognition, natural language processing, and more. However, the most accurate approach, renowned for its efficacy, is the AI-powered template-based technique. This method leverages natural language processing to identify key-value pairs within documents and autonomously extracts data with the highest accuracy.

Improved Efficiency: Automated medical record data extraction minimizes the need for laborious manual tasks, liberating healthcare professionals from administrative burdens and enabling them to focus on providing quality care. The time saved can be redirected toward patient engagement, research, or other value-added activities.

Enhanced Accuracy: Human errors and inconsistencies can have significant implications for patient safety and outcomes. Data extraction automation reduces the risk of data entry mistakes, ensuring precise and reliable information is available for analysis, treatment planning, and research purposes.

Data Standardization: Automated extraction tools facilitate the standardization of diagnostic data by enforcing consistent formatting and categorization. This standardization simplifies data aggregation, enables interoperability, and paves the way for comprehensive data analytics and reporting.

Scalability and Speed: With the exponential growth of healthcare data, manual extraction processes become increasingly unfeasible. Automated tools can swiftly handle large volumes of medical records, ensuring that diagnostic data is promptly available for analysis, clinical trials, and population health management initiatives.

Advanced Analytics: The extracted diagnostic data can be seamlessly integrated into advanced analytical platforms, leveraging artificial intelligence and predictive modeling techniques. These insights can drive proactive interventions, identify patterns, and optimize treatment pathways, improving patient outcomes and operational efficiencies.

Facilitating the Data Integration Process

Automated data extraction tools play a pivotal role in seamlessly integrating with existing Electronic Health Records (EHRs) systems. Integration between these two components is crucial for efficient data retrieval and management. By working in harmony with EHR systems, automated extraction tools can extract diagnostic data from various sources within the patient’s medical records, including structured fields, clinical notes, and scanned documents.

Integration begins by establishing secure connections and APIs between the data extraction tool and the EHR system. This allows for direct access to patient records, ensuring real-time retrieval and extraction of diagnostic data. The extraction tool employs intelligent algorithms to navigate the EHR’s structured and unstructured data, extracting relevant information such as lab results, imaging reports, and clinical observations.

By integrating with EHRs, healthcare businesses can leverage the benefits of automated data extraction without disrupting established workflows. When considering the implementation of automated data extraction tools, healthcare businesses should evaluate the integration and end-to-end data management capabilities to ensure seamless data management across systems.

A Final Word

Harnessing the power of diagnostic data is critical for healthcare businesses to improve patient care, enhance research capabilities, and drive operational excellence. By embracing automated medical record data extraction tools, organizations can unlock the true potential of this valuable information.

Many healthcare organizations trust LIKE.TG ReportMiner, our enterprise-grade, no-code data extraction tool, to unearth valuable insights from semi-structured and unstructured documents, including diagnostic data. Our AI-powered solution simplifies and streamlines end-to-end document processing, including extraction, integration, validation, and loading.

Unleashing Cash Flow Potential through Invoice Data Extraction

Within the dynamic landscape of financial services, businesses are constantly seeking new ways to improve cash flow and stay ahead of the competition. One area that holds significant potential is automated invoice data extraction.

By leveraging cutting-edge technology, financial service providers can streamline their invoicing processes, reduce errors and delays, and ultimately optimize their cash flow potential.

What is Cash Flow Management and Why is It Important?

Cash flow refers to the consistent inflow and outflow of money within a financial service business, which is of utmost importance for its survival. Numerous profitable financial service businesses risk closure because they don’t have sufficient cash to meet their financial obligations when they become due.

Positive cash flow fuels growth, help organizations meet obligations, and empowers strategic maneuvering. When it comes to optimizing cash flow, automating extraction of invoice data is indispensable to receiving accurate and timely financial data.

How Efficient Invoice Processing Bolster Cash Flow

Automating and streamlining the invoicing process allows financial service businesses to monitor and track outstanding payments more effectively. By promptly following up on overdue invoices, accounts payable (AP) departments can take the necessary steps to arrange for funds. This may involve contacting clients to inquire about their payment status, negotiating better payment terms, or availing early payment discounts.

By staying on top of outstanding payments, financial service businesses can better manage their cash flow and make informed decisions regarding their financial commitments and expenditures. Timely invoice processing also enhances transparency and communication between the business and its clients, reducing the likelihood of payment delays or disputes.

Ultimately, by prioritizing effective invoice processing, businesses can cultivate a stronger financial foundation and ensure a steady cash flow to support their operations and growth.

How Much of a Difference Can an Invoice Data Extraction Tool Make?

An invoice data extraction tool substantially reduces invoice processing time, paving the way for cost savings and enhanced vendor partnerships. On average, automated data extraction empowers the finance team to process invoices roughly 10 times faster.

In other words, if a finance department was processing just 50 invoices per employee each week, data extraction automation can make that number jump to 500 invoices. And we’re just talking averages here. One of our clients, a consumer finance company, successfully reduced invoice processing time from 25.5 days to a mere 24 hours. That’s more than 24 times faster!

Another client, a mortgage lender, successfully downscaled their document processing department from 25 employees to 15 employees in the first year and further to just three employees in the second year. Meanwhile, they achieved a remarkable eightfold improvement in invoice processing efficiency. This efficiency not only provides cost benefits but also streamlines the invoice approval and payment process, guaranteeing timely payments to vendors or suppliers.

Consequently, businesses avoid late payment fees, cultivate positive vendor relationships, and position themselves for improved negotiation opportunities.

The Potential Cost Savings

Suppose a financial service company receives 4,000 invoices from 30 different vendors every month, each with a different structure and layout. Oftentimes, even invoices from a single supplier vary in format. Processing these invoices manually can be a time-consuming, error-prone, and labor-intensive activity, but with automation, not so much! In fact, it’s the other way around.

Automating data extraction can significantly accelerate invoice processing, eliminate human errors, and streamline payment processing. Not to mention the cost savings that financial service companies can derive using automated data extraction.

For example, an average employee can process five invoices in an hour, which translates to 40 in a day or 800 monthly. This means the financial service company must dedicate five full-time employees to process invoices. Given the average salary for an invoice processor in the US is $39,523 per year, the company would save $197,615 annually by automating this process.

Final Word

Automated invoice processing can greatly improve the cash flow of a financial service company. By implementing automation, invoice data becomes more precise, comprehensive, and easily accessible, which ultimately optimizes the cash flow of your business. Additionally, the enhanced visibility and usability of data simplifies the auditing process.

LIKE.TG ReportMiner—The Ultimate Automated Data Extraction Tool

LIKE.TG ReportMiner is our state-of-the-art data extraction automation solution, now powered by the advanced NLP algorithm, LIKE.TG North Star.

Our tool revolutionizes invoice processing, enabling the rapid extraction of data from diverse invoices within minutes with minimal manual intervention. Imagine being able to process 100 different invoices in minutes. With ReportMiner, this level of efficiency is routine.

Moreover, our code-free solution goes beyond automating data extraction; it also comes with an automated data verification feature. You can define custom data quality rules to guarantee the utmost accuracy of the data extracted from invoices.

Additionally, ReportMiner enables the seamless integration of invoice data into automated data pipelines to enable end-to-end automation. Our tool is compatible with AP automation solutions, facilitating efficient payment processing as well as seamless reporting and analytics.

Do you want to learn more about how to automate invoice processing with LIKE.TG ReportMiner and ensure your cash flow statements stay green? Check out this free eBook:

Free Ebook - Leverage Untapped Unstructured Data For Maximum Effectiveness

Download Now

Optimizing Lawyer Performance: The Power of Automated Legal Document Data Extraction Tools

In the modern legal system, law firms manage vast volumes of paperwork daily. Given how legal professionals spend hours on extracting useful information from countless legal documents every day, law firms are constantly seeking innovative solutions to streamline their data management processes and improve efficiency.

One such solution gaining traction is automated legal document data extraction – a groundbreaking technology with the potential to reshape how lawyers consume data. Here, by harnessing the power of automation for information extraction from legal documents, law firms can optimize their efficiency, empower their lawyers, and ultimately deliver enhanced legal performance.

Automated Data Extraction for the Legal Fraternity

Automated data extraction refers to the process of utilizing advanced artificial intelligence (AI) algorithms and machine learning (ML) techniques to automatically identify and extract valuable information from various sources. By leveraging intelligent algorithms, automated data extraction tools swiftly analyze documents and extract specific data on their own. This eliminates the need for manually extracting and loading data from each document.

Given the inefficiencies and inconsistencies associated with manually processing hundreds of critical legal documents, automated legal document data extraction is a promising solution. By automating this otherwise labor-intensive task of information extraction, law firms can achieve remarkable improvements in efficiency, accuracy, and overall lawyer performance.

Streamlining Document Management for Lawyers

Manual data extraction from legal documents is not only time-consuming but also prone to human errors. On the other hand, automated data extraction tools provide a solution by swiftly and accurately extracting relevant information, freeing lawyers from the burden of manual data entry. Here are a few ways in which these tools can optimize document management for lawyers:

Swift Extraction of Relevant Information:

Given how automated data extraction tools use AI and ML to quickly extract required data in real-time, lawyers no longer need to spend hours manually sifting through documents to locate and record crucial information.

Reduction of Manual Data Processing:

By automating the extraction process, lawyers can also minimize the need for manual data processing, which is otherwise inefficient and prone to errors. Extracted data is directly transferred to the firm’s database or case management system, eliminating the need for tedious manual input.

Enhanced Organization and Indexing:

Automated data extraction tools can automatically organize and index extracted data, making it easier to search, retrieve, profile, and reference specific information when needed. This feature saves lawyers valuable time that would otherwise be spent on manual organization and ensures quick access to relevant data during case preparation or legal research.

Extraction from Multiple Document Types:

AI-driven data extraction tool handle various types of disparate sources with different formats e.g., Pdfs, images, text files, XMLs, JSON, etc. Similarly, they can extract information from diverse legal documents including contracts, court filings, discovery materials, and legal research papers.

Seamless Integration with Existing Systems:

Automated data extraction tools can seamlessly integrate with existing document management systems, case management software, or other legal technology platforms. This integration allows for a smooth workflow, with extracted data seamlessly flowing into the firm’s existing infrastructure without disruption.

Enhanced Data Security and Confidentiality for Document Management:

Confidentiality and security of legal documents is of utmost importance in the legal sphere. Automated document data extraction tools can ensure data security and confidentiality by adhering to strict privacy standards and implementing robust encryption measures. By minimizing the need for manual handling sensitive information, these tools reduce the risk of data breaches and unauthorized access. Additionally, quality tools come equipped with safety features such as access controls, encryptions, audit trails, etc.

Enhanced Accuracy and Consistency

In legal affairs and proceedings, precision and consistency carry immense significance The risk of human errors in manual data extraction can have severe consequences, including misinterpretation of clauses, inaccurate representation of facts, and compromised legal arguments. Automated data extraction tools significantly reduce the margin of error—given their lack of reliance on manual data entry—ensuring accurate and consistent extraction of data from legal documents.

Additionally, powerful document data extraction tools also provide in-built quality and validation checks. With such measures in place, the extracted data can automatically be cleansed of errors. Subsequently, by accessing accurate and reliable data, lawyers can be confident about the veracity of their information, leading to better-informed decisions, stronger legal arguments, and improved overall legal outcomes.

Accelerating Legal Research and Analysis

Legal research is a time-consuming task that involves poring over vast volumes of legal texts, searching for relevant precedents, statutes, and case law. Automated data extraction tools expedite the research process by swiftly identifying and extracting any required information from legal documents. This allows lawyers to access critical legal insights faster, analyze and synthesize information more efficiently, and ultimately develop stronger legal strategies. By accelerating legal research and analysis, automated data extraction tools empower lawyers to provide well-founded advice, make informed decisions, and deliver superior outcomes for their clients.

The Final Verdict

The utilization of automated data extraction tools in the legal domain marks a paradigm-shift in how legal professionals manage and leverage information. By leveraging this technology, law firms can streamline document management, enhance accuracy and consistency, and accelerate legal research. Lawyers can shift their focus to higher-value tasks, such as legal analysis, strategy development, and client communication, ultimately delivering superior legal services.

As the legal industry embraces the power of automated data extraction, law firms that adopt this technology will gain a competitive edge, positioning themselves as leaders in efficiency, accuracy, and client satisfaction.

In case you want to see a powerful automated data extraction tool in action, check out the LIKE.TG ReportMiner. It is a cutting-edge document data extraction tool with AI capabilities that empowers law firms to extract useful information from even unstructured legal sources at scale.

Sign up for a free 14-day trial today and gear up to deploy a reliable data extraction tool now.

Unleashing Cash Flow Potential through Invoice Data Extraction

Unlocking the power of financial data automation drives operational efficiency, enables data-driven decision-making, and accelerates business growth

Within the dynamic landscape of financial services, businesses are constantly seeking new ways to improve cash flow and stay ahead of the competition. One area that holds significant potential is automated invoice data extraction.

By leveraging cutting-edge technology, financial service providers can streamline their invoicing processes, reduce errors and delays, and ultimately optimize their cash flow potential.

What is Cash Flow Management and Why is It Important?

Cash flow refers to the consistent inflow and outflow of money within a financial service business, which is of utmost importance for its survival. Numerous profitable financial service businesses risk closure because they don’t have sufficient cash to meet their financial obligations when they become due.

Positive cash flow fuels growth, help organizations meet obligations, and empowers strategic maneuvering. When it comes to optimizing cash flow, automating extraction of invoice data is indispensable to receiving accurate and timely financial data.

How Efficient Invoice Processing Bolster Cash Flow

Automating and streamlining the invoicing process allows financial service businesses to monitor and track outstanding payments more effectively. By promptly following up on overdue invoices, accounts payable (AP) departments can take the necessary steps to arrange for funds. This may involve contacting clients to inquire about their payment status, negotiating better payment terms, or availing early payment discounts.

By staying on top of outstanding payments, financial service businesses can better manage their cash flow and make informed decisions regarding their financial commitments and expenditures. Timely invoice processing also enhances transparency and communication between the business and its clients, reducing the likelihood of payment delays or disputes.

Ultimately, by prioritizing effective invoice processing, businesses can cultivate a stronger financial foundation and ensure a steady cash flow to support their operations and growth.

How Much of a Difference Can an Invoice Data Extraction Tool Make?

An invoice data extraction tool substantially reduces invoice processing time, paving the way for cost savings and enhanced vendor partnerships. On average, automated data extraction empowers the finance team to process invoices roughly 10 times faster.

In other words, if a finance department was processing just 50 invoices per employee each week, data extraction automation can make that number jump to 500 invoices. And we’re just talking averages here. One of our clients, a consumer finance company, successfully reduced invoice processing time from 25.5 days to a mere 24 hours. That’s more than 24 times faster!

Another client, a mortgage lender, successfully downscaled their document processing department from 25 employees to 15 employees in the first year and further to just three employees in the second year. Meanwhile, they achieved a remarkable eightfold improvement in invoice processing efficiency. This efficiency not only provides cost benefits but also streamlines the invoice approval and payment process, guaranteeing timely payments to vendors or suppliers.

Consequently, businesses avoid late payment fees, cultivate positive vendor relationships, and position themselves for improved negotiation opportunities.

The Potential Cost Savings

Suppose a financial service company receives 4,000 invoices from 30 different vendors every month, each with a different structure and layout. Oftentimes, even invoices from a single supplier vary in format. Processing these invoices manually can be a time-consuming, error-prone, and labor-intensive activity, but with automation, not so much! In fact, it’s the other way around.

Automating data extraction can significantly accelerate invoice processing, eliminate human errors, and streamline payment processing. Not to mention the cost savings that financial service companies can derive using automated data extraction.

For example, an average employee can process five invoices in an hour, which translates to 40 in a day or 800 monthly. This means the financial service company must dedicate five full-time employees to process invoices. Given the average salary for an invoice processor in the US is $39,523 per year, the company would save $197,615 annually by automating this process.

Final Word

Automated invoice processing can greatly improve the cash flow of a financial service company. By implementing automation, invoice data becomes more precise, comprehensive, and easily accessible, which ultimately optimizes the cash flow of your business. Additionally, the enhanced visibility and usability of data simplifies the auditing process.

LIKE.TG ReportMiner—The Ultimate Automated Data Extraction Tool

LIKE.TG ReportMiner is our state-of-the-art data extraction automation solution, now powered by the advanced NLP algorithm, LIKE.TG North Star.

Our tool revolutionizes invoice processing, enabling the rapid extraction of data from diverse invoices within minutes with minimal manual intervention. Imagine being able to process 100 different invoices in minutes. With ReportMiner, this level of efficiency is routine.

Moreover, our code-free solution goes beyond automating data extraction; it also comes with an automated data verification feature. You can define custom data quality rules to guarantee the utmost accuracy of the data extracted from invoices.

Additionally, ReportMiner enables the seamless integration of invoice data into automated data pipelines to enable end-to-end automation. Our tool is compatible with AP automation solutions, facilitating efficient payment processing as well as seamless reporting and analytics.

Automate Data Extraction With LIKE.TG ReportMiner

View Demo

EDI Tools: A Comprehensive Guide

What are EDI Tools? Today, seamless integration and efficient data exchange drive business success across industries.Electronic Data Interchange (EDI) is one of the fastest and most reliable channels businesses use for B2B communication. These businesses rely on various EDI tools and solutions to simplify their data exchange processes. EDI tools are powerful software applications designed to automate and facilitate the exchange of structured business documents between systems, organizations, or trading partners. These documents frequently include purchase orders (PO), invoices, shipping documents, healthcare claims, etc. EDI Tools: Streamlining B2B Data Exchange These tools streamline the entire data exchange process by ensuring compatibility and consistency in data formats. Modern EDI solutions are efficient, accurate and offer secure integration, eliminating manual processes and, at the same time, enabling you to remain EDI compliant. Types of EDI Tools EDI tools come in various forms, each specifically designed to address different aspects of electronic data interchange and cater to unique business requirements. These tools streamline data exchange and improve integration efficiency and collaboration with trading partners. Here are the most common types of EDI tools you can find: EDI Translation Software: EDI translators offer a user-friendly interface to transform and map data. They allow you to convert data from your internal systems into standardized EDI formats that your trading partners support. Communication Gateways: These are communication-focused tools that establish secure connections using protocols like FTP, AS2, or SFTP. Communication gateways also handle the encryption and decryption of data, provide authentication mechanisms, and enable error detection and recovery. Trading Partner Management Tools: These tools simplify managing trading partner relationships. They provide a centralized platform where you can onboard new trading partners, configure their specific EDI requirements, and establish communication channels. You can also leverage features like partner profile management to store and maintain information about each trading partner. While each of these tools can do their jobs sufficiently well, they cannot handle the EDI process from end to end. For this reason, businesses look toward full-fledged EDI tools or platforms with comprehensive features. The Need for a Unified EDI Tool Now, let’s discuss why a unified EDI tool is essential for your integration efforts. A unified EDI tool consolidates different functionalities into a single comprehensive solution. It’s your secret weapon to achieving operational excellence. CCHP Hits 99% Data Submission and Approval Rates With LIKE.TG EDIConnect Download Case Study Here are some more reasons why you should opt for a comprehensive EDI solution: Simplified Integration First off, a unified EDI tool simplifies your integration efforts. You no longer have to use multiple standalone tools to use various aspects of EDI. Instead, everything you need is consolidated into one comprehensive solution. It’s like having all your integration superpowers in a single tool, saving you time, effort, and resources. You should also think about the complexity that arises when you’re managing multiple tools. Each one has its own configuration, interface, and learning curve. But with a unified EDI tool, you can bid farewell to that chaos. You’ll have all the necessary features and capabilities neatly organized in one place, like a centralized control center for your integration operations. Holistic View One of the most significant advantages of a unified EDI tool is the holistic view it provides. Picture yourself overlooking your entire data exchange process from a single dashboard. You can monitor data flows, track transactions, and quickly identify hiccups or bottlenecks. This bird’s-eye view of your integration landscape empowers you to take prompt actions and optimize your processes for better efficiency. Seamless Coordination With all the components of your EDI operations seamlessly coordinated within a unified tool, you can achieve smoother data flows and improved synchronization with your trading partners. You no longer have to worry about data discrepancies or misinterpretations during document exchange. Faster Business Cycles The benefits of a unified EDI tool extend beyond streamlined processes. They directly impact your business cycles, from procurement and production to order fulfillment and customer service. By consolidating your EDI functionalities, you speed up document exchange and enhance communication with your trading partners. This means improved supply chain efficiency, faster order processing, and, ultimately, happier customers. Put concisely, a unified EDI tool is like having a trusted companion that simplifies your integration efforts. Factors to Look for in a Comprehensive EDI Solution When selecting an EDI tool for your business, it’s crucial to take a comprehensive approach and consider a range of factors to ensure you make the right choice. It’s not just about ticking off a checklist of features; it’s about finding the right solution that aligns with your business needs and objectives. In this pursuit, you should take the following factors into account: Automation Automated data exchange between your trading partners enables you to free up resources that you can allocate to more value-added tasks within your organization. It also streamlines the exchange of EDI documents. For example, the tool can automatically route purchase orders to the appropriate departments for review and approval, trigger order fulfillment processes, and generate acknowledgments or invoices. Additionally, by leveraging automation, you can also reduce labor costs associated with data entry, document handling, and error correction. Experience Effortless Data Exchange With Your Trading Partners Learn More Compliance and Standards Your trading partners may have their own preferred EDI standards and document formats. You may also be regularly onboarding new trading partners who use different EDI standards or document types. Therefore, compliance with industry-specific regulations and EDI standards should be the top priority for you and your trading partners. Ensure the solution adheres to all regulations and supports relevant EDI standards like EDIFACT, X12, or XML. For example, healthcare organizations must comply withHIPAA(Health Insurance Portability and Accountability Act) regulations, while retail businesses may need to adhere to GS1 standards. Scalability A scalable EDI tool ensures that you can expand your operations without facing limitations or disruptions. As your business grows, your integration requirements will change. For that, you need a solution that can quickly adapt to accommodate increased transaction volumes, additional trading partners, and evolving business processes without sacrificing performance or experiencing delays. Moreover, salability is a long-term consideration when choosing an EDI tool. It ensures that the selected tool can scale as needed without frequent system upgrades or replacements. Data Mapping and Transformation When it comes to data mapping and transformation, always look for a solution that offers a user-friendly interface and support for various data formats and standards. The interface should be intuitive and easy to navigate, allowing users to configure mapping rules without requiring extensive technical knowledge or coding skills. This flexibility enables your teams to integrate systems seamlessly. The EDI tool should also provide robust support for data transformations. Ensure that it offers a comprehensive set of transformation functions, such as date formatting, conditional logic, and data enrichment through lookups or database operations. Communication Protocols Your EDI tool should support a wide range of secure communication protocols so that you can accommodate all your trading partners. These protocols are essential for establishing reliable connections with them and ensuring the secure exchange of business documents. Some of these protocols include: AS2 (Applicability Statement 2) and AS4 FTP (File Transfer Protocol) and SFTP HTTP and HTTPS Error Handling and Validation EDI tools utilize validation rules to verify the correctness of data in EDI transactions. These rules can include checks for data type, length, format, mandatory/optional fields, and adherence to specific business rules or industry standards. The tool compares the data in the transaction against these rules to identify any violations or errors. Specific error handling and validation functionalities can vary across different EDI tools greatly. The level of customization also varies based on the tool’s features. Ensure that the EDI tool you choose has robust error handling and validation mechanisms in place. These mechanisms should be able to identify various types of errors and, subsequently, notify you to take necessary actions promptly. LIKE.TG EDIConnect: A Comprehensive EDI Solution for Modern Businesses Modern organizations conduct business at a rapid pace, driven by advancements in technology and the demand for instant, reliable connectivity. LIKE.TG EDIConnect offers a complete EDI solution fueled by automation. It streamlines the entire B2B data exchange process with its powerful integration engine and intuitive UI. Enable Frictionless B2B Data Exchange With LIKE.TG EDIConnect View Demo Here are more reasons to consider EDIConnect: Intuitive User Interface: Our EDI tool offers an intuitive and user-friendly interface that allows for drag-and-drop visual mapping. This makes handling complex hierarchical structures like EDI and XML seamless and straightforward. Automation and Process Orchestration: Easily define process orchestration for both incoming and outgoing EDI files. With this functionality, you can automate tasks such as file download/upload, generating acknowledgements, invoking data maps, and sending emails. Translation Capability: Leverage the built-in high-performance EDI translator to efficiently process data volumes of any size, ensuring optimal performance and scalability. Validation Functionality: The integrated validator seamlessly performs standard and custom validations, ensuring data integrity and compliance with EDI standards. Simplified Transaction Building: EDIConnect’s transaction builder simplifies the process of building complex hierarchical EDI transactions, even for business users. Repository Manager: It includes a built-in repository manager, providing a comprehensive library of pre-defined templates for various business transactions. Efficient Partner Management: The partner manager component allows you to define and manage EDI partner information. Now that you’re equipped with a deeper understanding of EDI tools and their importance for seamless integration, it’s time to see how LIKE.TG EDIConnect simplifies document exchange. Sign up for a free demo or call +1 888-77-LIKE.TG and we’ll have one of our solution experts on the line to assist you with your use case.

How One Law Firm Saves 75% Time with Automated Legal Document Data Extraction

Revolutionize Your Law Firm’s Workflow in the Digital Age of Legal Document Management

In the information age, legal firms find themselves navigating through an ocean of documents. The demand for meticulous attention to detail in these legal documents is paramount, and efficient data extraction plays a pivotal role in effective document management. Fortunately, a new era is dawning with the emergence of automated tools, poised to revolution

ize the way legal firms handle data extraction and document management.

The Document Management Dilemma: Navigating Legal Industry’s Data Deluge

In the realm of the legal industry, documents are the lifeblood that keeps the system alive. From contracts to affidavits, and court filings to legal briefs, these documents form the foundation of all legal proceedings and transactions.

Power of Efficient Extraction in Legal Documents

In the legal industry, data is the key to making informed decisions and driving successful outcomes. For legal firms, extracting critical information from these documents in a timely and accurate manner is not just a necessity; it’s pivotal to their operations.

The extracted data forms the basis for case analysis and strategic planning and forms the legal argumentation. Hence, efficient data extraction is not an option but a requisite for the firm to maintain its competitiveness and deliver high-quality legal services to its clients.

The Business Case: A US-based Law Firm Saves 75% Time

Central Role of Legal Documents

Johnson Associates is a high-powered legal firm that handles a vast array of legal cases from corporate law and intellectual property rights to civil litigation and employment law. The nature of their operations involves a huge volume of legal documents to be processed daily including contracts, legal briefs, court filings, and other legal and transactional documents.

Road to Streamlining Processes

Manual data extraction posed several challenges to the operations of Johnson Associates. One of the significant problems was the labor-intensive nature of the task. Each document needed to be meticulously read and interpreted, requiring a great deal of effort and concentration. This was especially challenging given the volume of documents the firm processed daily, which was approximately 200 on average.

Secondly, the complexity and variety of legal documents added another layer of challenge. The diverse nature of the firm’s work meant that they were handling various types of documents, each with its unique structure and content. This made it more complicated and time-consuming to extract the necessary data.

Additionally, the firm also faced challenges with data accuracy. Manual data extraction, by its nature, is prone to human error. Misinterpretations, missed data points, and simple typing errors were not uncommon and caused significant implications.

The LIKE.TG Solution

Recognizing the challenges posed by manual data extraction, Johnson Associates made the strategic decision to implement LIKE.TG ReportMiner as their automated data extraction solution. The firm saw the potential for significant time savings, improved efficiency, and enhanced accuracy by leveraging this cutting-edge technology.

Revolutionizing Extraction and Integration

Johnson Associates successfully integrated LIKE.TG ReportMiner into their existing workflow. The firm’s IT team collaborated with LIKE.TG’s experts to customize extraction templates and define rules specific to their requirements, ensuring a smooth transition. From the get-go, Johnson Associates were empowered with the following capabilities of LIKE.TG ReportMiner:

Legal Document Data Extraction from: Powered by AI to extract essential data from contracts, court filings, and legal briefs, reducing time spent by employees and improving data accuracy.

Data Integration: Collates data from diverse sources like PDF files, Excel spreadsheets, and scanned images, normalizing it for streamlined analysis and decision-making.

Workflow Automation: Automates extraction tasks on a schedule, minimizing manual oversight and ensuring up-to-date data availability.

LIKE.TG ReportMiner empowers the firm to focus on its legal expertise while benefiting from reliable and automated data management.

Johnson Associates’ Triumph

The implementation of LIKE.TG ReportMiner yielded remarkable results for Johnson Associates. By replacing manual data extraction with automated processes, the information that their team of 12 people took 32 work hours to extract, they were now able to achieve with a single employee 8-hour shift. The firm experienced a remarkable time saving of 75%, alongside alleviating the need for new hiring. This improved efficiency allowed the legal firm to reduce costs significantly by allocating these resources to core responsibilities such as case analysis, strategy formulation, and client consultations

Conclusion

Revolutionize Your Law Firm’s Workflow, particularly Legal Document Management, can save significant time by streamlining document organization, retrieval, and collaboration processes, improving efficiency and reducing manual errors. LIKE.TG ReportMiner offers a reliable solution to automate data extraction from complex legal documents, such as contracts and court filings, enabling swift analysis and report generation. This powerful tool enhances accuracy, accelerates decision-making, and ultimately saves time in the legal document management workflow.

Automate Document Data Extraction with LIKE.TG ReportMiner

Download Trial

Revolutionizing Patient Data Management: How a US-based Insurance Company Saved more than $100,000 in Annual Costs

In the dynamic world of insurtech, where innovation is the key to success, insurance companies constantly seek ways to optimize their operations and unlock new opportunities. Among them, a US-based company, a renowned player in the industry, recognized the immense potential of automating their patient data management system. By embracing the power of an AI-driven tool, the company embarked on a journey of transformation, unlocking a wealth of benefits along the way.

Let’s explore how the insurance company in question seized the opportunity to save costs, boost operational efficiency, and gain a competitive edge, ultimately propelling them to the forefront of the ever-evolving insurance landscape.

Background of the Company

Over the past two decades, this company has been at the forefront of the insurance industry, catering to the needs of over 10,000 clients through an array of comprehensive insurance services. Their operations span across risk assessment, policy underwriting, claims management, and customer service, ensuring a holistic solution to their clients’ insurance needs. They’ve built a strong reputation based on their ability to provide customized insurance solutions while maintaining a high level of customer satisfaction. However, as the insurance landscape continues to evolve, so does the necessity for the company to innovate and enhance its operational efficiency.

The Challenge

Navigating the insurance landscape, the company found itself grappling with several challenges. Insurance, as an industry, is largely data-driven with decision-making heavily reliant on accurate and timely data. Medical records, in particular, contain crucial information that directly impacts the assessment of claims and policy underwriting.

With an average of 3,000 medical records to process each month, the sheer volume of data was proving to be overwhelming for the company. The intricacies of medical terminology and the need for precise extraction added another layer of complexity. In an industry where accuracy could significantly influence a claim’s outcome, even minor errors could lead to serious consequences.

In terms of costs, the financial burden of manual data extraction was staggering. With each medical record taking about 30 minutes to transcribe, this translated to over 1,500 hours of labor each month. Assuming an average wage of $15 per hour for data entry personnel, the cost of manual data extraction amounted to $22,500 per month, or a whopping $270,000 annually.

Additionally, the potential for human error introduced another cost factor. Even with a conservative error rate of 2%, this meant that 60 records each month required rework. With each error costing the company an additional $30 on average, this added up to $21,600 annually.

Furthermore, in an industry as competitive as insurance, the inability to promptly process claims due to slow data extraction could lead to customer dissatisfaction and a potential loss of business. This indirect cost, although harder to quantify, further underscored the urgent need for a more efficient data extraction solution.

It was clear that for the said Insurance company to stay competitive and cost-effective, a solution to automate the medical record data extraction process was essential. The chosen solution would need to address these industry-specific challenges and reduce the significant financial burden associated with manual data extraction.

Solution: Moving towards AI-driven Automation

Amidst data extraction challenges, LIKE.TG ReportMiner emerged as a transformational solution for the company, enhancing their patient data management system. This advanced software streamlined processes that once took hours into less than a minute, promising to transform the laborious task of processing 3,000 records per month.

For example, insurance claims often come with a myriad of supporting documents – doctors’ notes, lab results, medical invoices, and more. Each of these documents has its own format and key data points. ReportMiner’s AI Capture allowed the company to create report models with a single click. This enabled the extraction of essential data from varied documents swiftly, saving up to 80% of time and effort previously spent on manual layout creation.

Moreover, the company leveraged the tool to automatically identify and extract critical data points, such as patient names, procedure codes, and billed amounts from medical invoices. They were able to automate the extraction of critical data from medical invoices, automate the creation of tables for data analysis, and streamline their entire data pipeline. This not only improved the efficiency of their operations but also led to more accurate data, which in turn improved their decision-making capabilities.

Implementation

Shifting from manual data extraction to an automated process was a significant step for the company. The first step involved training a dedicated team on ReportMiner’s functionalities, including the use of AI Capture and the creation of extraction templates.

During the month-long transition process, manual and automated processes ran simultaneously to ensure service continuity. Despite initial challenges, the implementation was successful, and the company gradually reduced their dependence on the manual process by around 80%.

The implementation of ReportMiner and AI Capture led to a significant reduction in time and resources dedicated to data extraction. The software’s capability to process multiple files simultaneously meant that the task of processing 3,000 records per month became markedly more efficient, leading to quicker turnaround times and substantial cost savings.

The Impact of LIKE.TG ReportMiner

After implementation, the time taken to process each medical record dropped dramatically from 30 minutes to less than a minute, marking a 96% decrease in processing time and a reduction of $90,000 in annual costs.

Initially, with the manual process, the company faced a 2% error rate, which cost them $21,600 annually. After ReportMiner’s implementation, the error rate fell to less than 0.5%, dramatically minimizing the need for rework and further conserving time and resources. This reduced the company’s yearly costs by $16,200.

The savings weren’t only monetary but also extended to the valuable time of their employees, who could now focus on other critical tasks.

Conclusion

LIKE.TG ReportMiner, enhanced with its AI Capture feature, proved to be a game-changer for the aforementioned firm. The drastic reduction in processing time, coupled with a significant drop in error rates, meant that the company could maintain its commitment to delivering excellent customer service while also driving down operational costs. The implementation of ReportMiner not only helped streamline the data extraction process but also signified the organization’s successful stride into the future of automated data extraction.

Transform Your Data Extraction Process

Ready to revolutionize your data extraction process and unlock new efficiencies in your operations? It’s time to consider LIKE.TG ReportMiner.

Embrace the future of data extraction with LIKE.TG ReportMiner and experience the power of AI-driven automation. Contact us today to learn more about how LIKE.TG ReportMiner can revolutionize your data extraction process.

What are EDI Transactions? Benefits & Techniques

Electronic data interchange (EDI) transactions play an instrumental part in enabling businesses to exchange business documents electronically. The projected CAGR of 12% between 2023 to 2028 underscores its crucial role in allowing seamless data exchange between trading partners in the coming years. Let’s delve deeper into EDI transactions to learn about its components, types, and benefits. What are EDI Transactions? EDI transactions refer to the exchange of business data in a standardized electronic format. These transactions allow businesses to send and receive various types of business documents, such as purchase orders, invoices, shipping notices, and more—seamlessly and efficiently. These electronic transactions are a great alternative to traditional paper-based communication methods, facilitating faster data exchange between trading partners. In today’s interconnected business landscape, businesses across various industries, ranging from retail and manufacturing to logistics and finance, heavily rely on EDI systems for business-to-business (B2B) communication. These transactions conform to specific standards, which improves data consistency and ensures transaction compatibility across different systems. The three key structural components of EDI transactions include: Segments: Segments are the building blocks of an EDI transaction that represent individual units of information. Each segment is delimited by specific characters and contains data elements that convey essential information in an EDI file. Data Elements: Data elements are the smallest units of information within a segment that carry specific pieces of data, such as names, numbers, dates, or codes. These elements are identified by their positions and meanings as per the EDI standard. Envelopes: Envelopes provide the structural framework for an EDI transaction. They serve as a container that marks the initiation and conclusion of the transaction and include details such as sender and receiver identifiers, control numbers, and timestamps. Enable Frictionless B2B Data Exchange With LIKE.TG EDIConnect View Demo Benefits of EDI Transactions EDI exchange provides numerous benefits that can transform business operations, including: Improved Efficiency: Automated data exchange through EDI transactions allow businesses to process documents more efficiently. Implementing an EDI solution can potentially bring down the transaction processing time from days or weeks to mere seconds. Reduced Errors: The adoption of EDI transactions virtually eliminates errors. No manual data input is involved in the process; hence, the potential for inaccuracies is significantly diminished—preventing unnecessary delays and saving valuable time and resources. Cost Savings: EDI transactions’ greater efficiency, combined with areduction in errors, allow businesses to enjoy substantial cost savings. The automation minimizes resources required to process transactions and helps prevent costly chargebacks, penalties, and fines that can affect the bottom line. Enhanced Data Security: EDI transactions incorporate encryption and privacy protocols, which improve data security and compliance. These transactions comply with industry regulations, such as HIPAA and GDPR, ensuring that sensitive data remains safeguarded. Enhanced Partnerships: EDI transactions foster enhanced partnerships by streamlining communication between trading partners. The timely exchange of crucial information and faster document processing cultivate trust and collaboration and strengthen business relationships. EDI Transaction Types EDI transactions are used to handle a wide array of business requirements. The standardized formats and protocols for each transaction ensure reliable information exchange between trading partners. Some of the common types of EDI transactions include: Purchase Order (850): This transaction initiates a purchase request from a buyer to a supplier, specifying the items, quantities, and terms of the order. Purchase Order Acknowledgment (855): The supplier uses this transaction to acknowledge the receipt and acceptance of a purchase order, confirming the details and setting expectations for fulfillment. Payment Order/Remittance Advice (820): This transaction facilitates electronic payment and includes remittance information such as invoice numbers, amounts, and payment details. Invoice (810): An invoice transaction is used to request payment for goods or services rendered, and may include itemized costs, payment terms, and any applicable discounts or taxes. Order Status Inquiry (869): Businesses use this transaction to inquire about the status of a previously placed order, or when seeking updates on fulfillment, shipment, or any related changes. Functional Acknowledgment (997): This transaction confirms the receipt, validation, and acceptance of other EDI transactions exchanged between trading partners. Health Care Claim (837): This transaction empowers healthcare providers to submit insurance claims to payers, containing detailed information on services rendered, diagnosis codes, and billing details. Health Care Eligibility/Benefit Inquiry (270): By leveraging this transaction, healthcare professionals can inquire about a patient’s insurance eligibility and benefits, as well as access essential information related to coverage, co-pays, and deductibles. Motor Carrier Load Tender (204): When offering a shipment to a carrier, this transaction includes vital details such as pickup and delivery locations, weight of a shipment, and any special instructions. Rail Carrier Shipment Information (404): Providing comprehensive rail shipment information, this transaction covers identification, equipment specifics, route details, and estimated arrival times. Final Thoughts EDI transactions play and will continue to play a vital role in B2B data exchange in the foreseeable future. EDI ensures consistent formats and rules for transaction processing, streamlining how information is shared, i.e., with accuracy and speed. A reliable EDI solution is paramount to maintaining accurate and secure data sharing in business processes. LIKE.TG EDIConnect is an intuitive EDI management tool with advanced features that empower businesses to optimize data exchange. Featuring an intuitive, no-code interface, it comes with advanced EDI capabilities to seamlessly build and process EDI documents with trading partners. Do you want to take your first step toward optimizing your B2B transactions today? Schedule a personalized demo today! See How LIKE.TG EDIConnect Helps Exchange Data Faster with Your Trade Partners View Demo

EDI Trucking: Revolutionizing Dispatch and Delivery in Logistics